arizona charitable tax credit list 2021

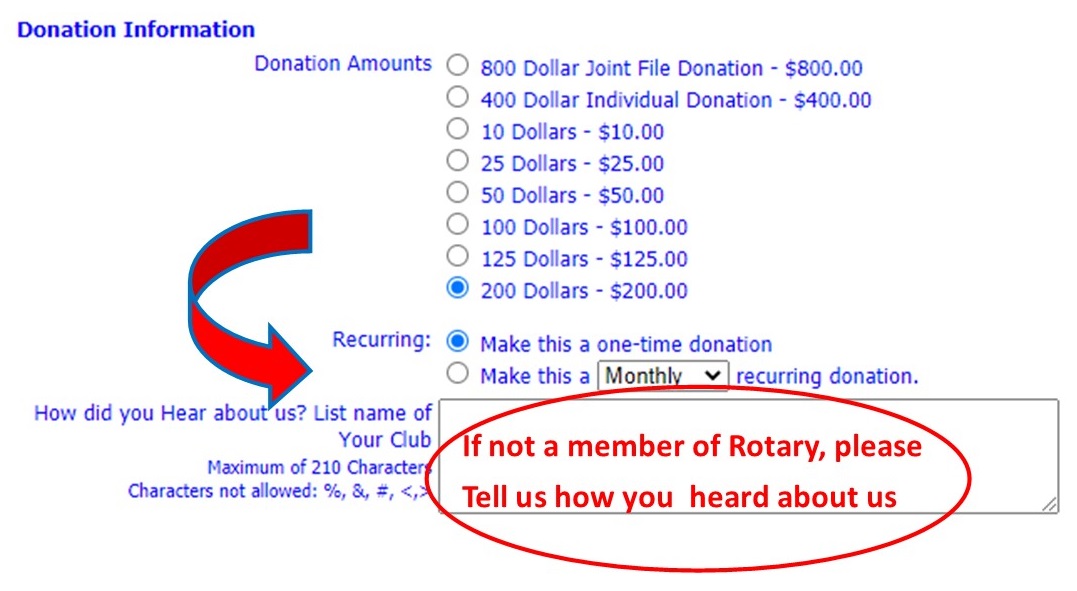

Maximum contributions are 400 for filing single or 800 for filing jointly. Your tax credit may be limited to 50 of the donation.

Watches For Men Women Watches Smartwatch Fashion Video In 2021 Watches For Men Smart Watch Smart Watch Android

One for donations to Qualifying Charitable Organizations and one for donations to Qualifying Foster Care.

. We covered the most important information needed to fully utilize the arizona charitable tax credit this 2021 tax year. Check out a quick video for a brief breakdown of the Arizona Charitable Tax Credit. Tax credits either reduce what you owe to the state or increase your refund dollar-for-dollar.

For those filing jointly it is up to 800. Learn More at AARP. For tax year 2021 the maximum credit allowed is 608 for single heads of household and married filing separate filers and 1214 for.

Everything you need to know to take advantage of the Arizona Charitable Tax Credit updated for the 2021 tax year. Contributions for the 2021 tax year can be made through April 18th 2022. RSM tax professionals have decades of experience customizing plans to honor your wishes minimize tax and help create your legacy.

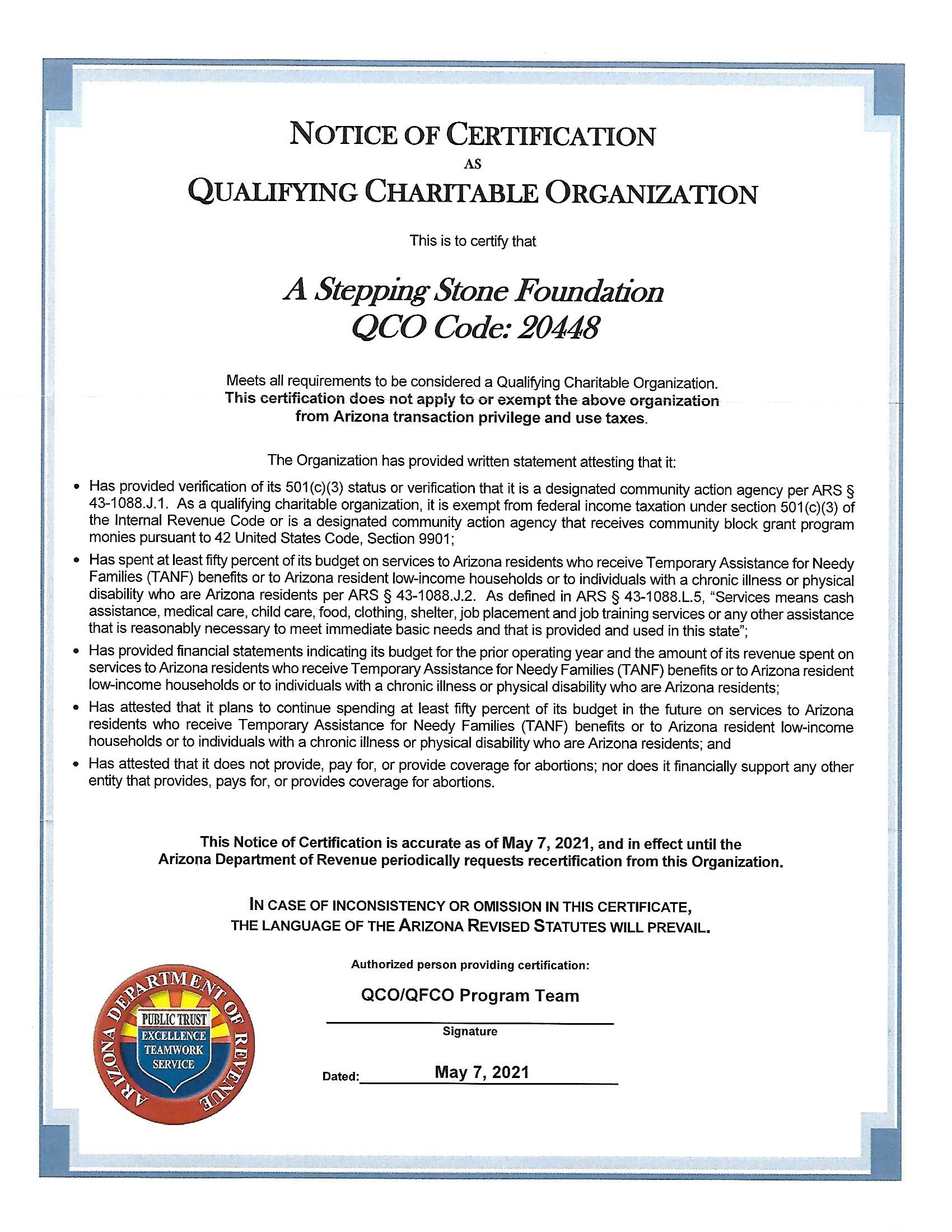

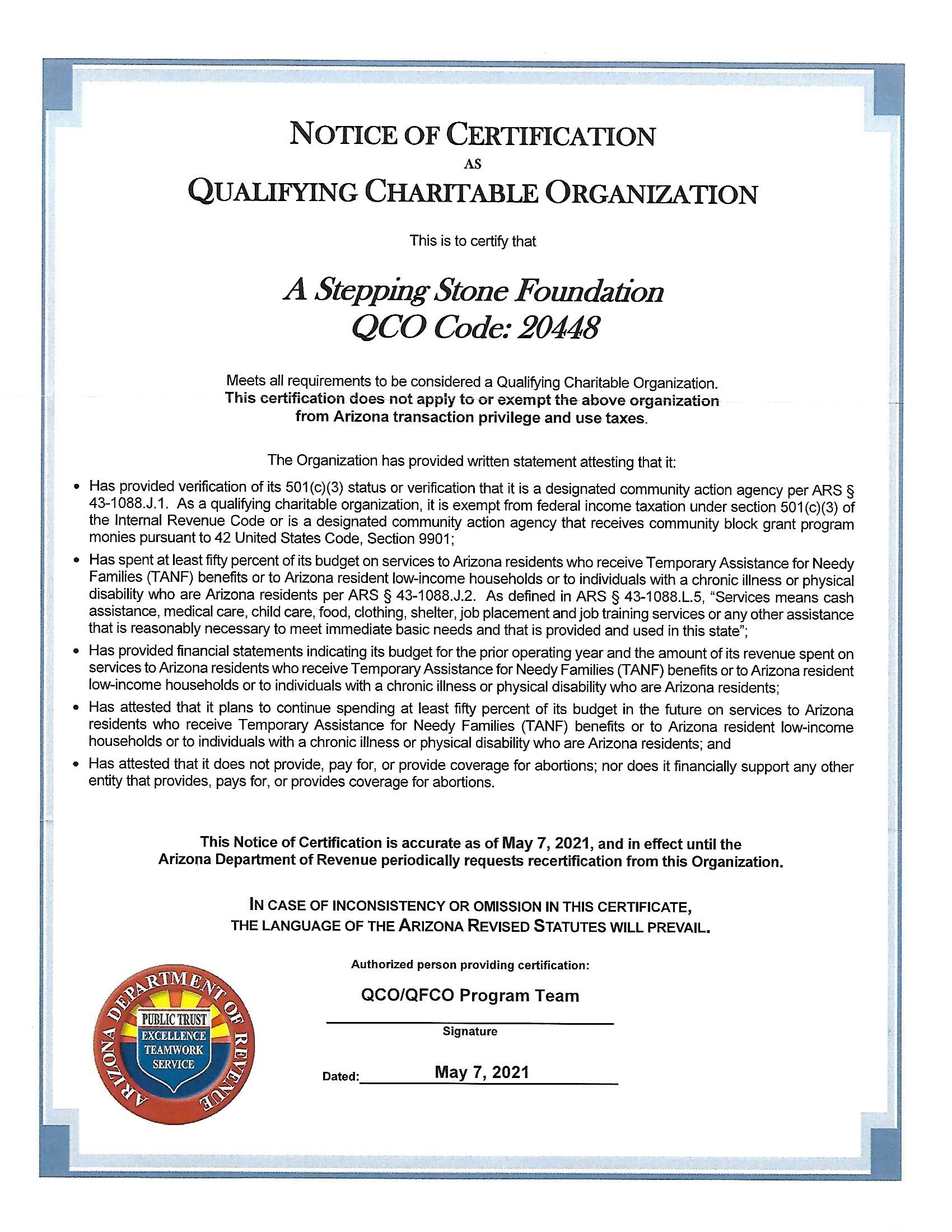

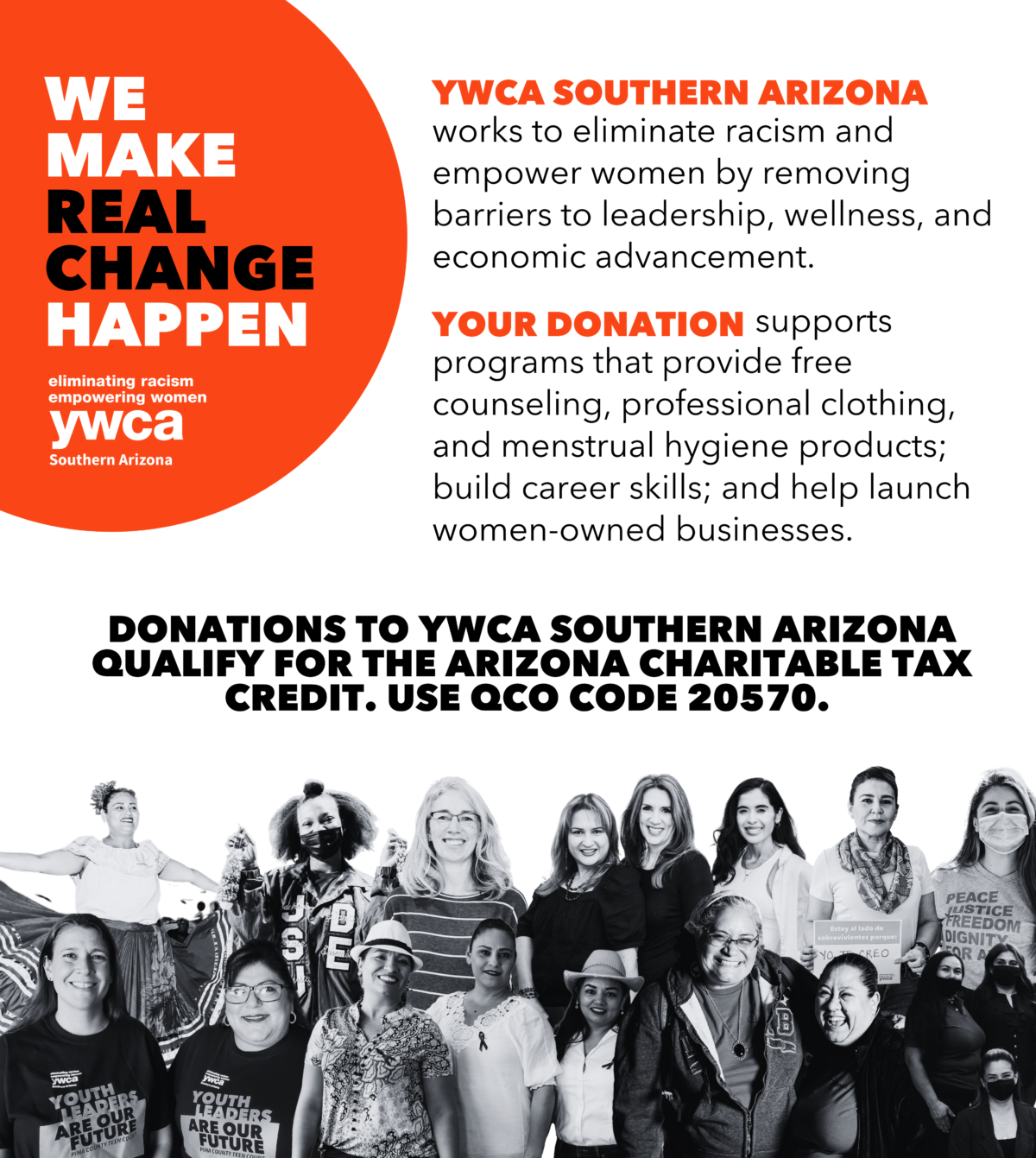

Qualifying Charitable Organization QCO Tax Credit The QCO formerly known as the Charitable Tax Credit single or head-of-household credit is up to 400. The Public School Credit program supports state eligible activities programs or purposes. Tax credits are more valuable than a tax deduction.

The Arizona Department of Revenue now requires taxpayers to report the schools County Code Type Code and District Code Site Number on Form 322 which is filed with the Arizona. Uses Tax Credit Form 321. You still have time.

Amounts contributed for the credit between January 1 2022 and April 15 2022 may be used once as a tax credit on either your 2021 or 2022 Arizona income tax return. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Fees or donations made between January 1 2022 and April 15 2022 can be claimed as a credit on your 2021 or 2022 state tax return.

Donations made between January 1 and April 18 2022 qualify to be claimed on either the 2021 or 2022 tax return. Special rules apply to individuals who are Married Filing Separate. In this example the charitable contribution portion of the payment is 60.

DONATIONS FOR TAX YEAR 2021 MAY BE MADE THROUGH APRIL 15 2022. Arizona Charitable Tax Credit Claim AZ Tax Credit for 2021 by 418. Please consult your tax advisor.

Here are the amounts for 2021. LIST OF QUALIFYING CHARITABLE ORGANIZATIONS FOR 2021 Name of Organization Address QCO Code Qualifying organizations for cash donations made between January 1 2021 and December 31 2021 22230 15 Hands Hearts Inc 8380 N Fleming Dr Flagstaff AZ 86004 20266 1st Way Pregnancy Center PO Box 5294 Phoenix AZ 85016. The state of Arizona provides a variety of individual tax credits including the Arizona Charitable Tax Credit and the Public School Tax Credit.

Marys Food Bank and get all of it back in your Arizona tax refund. Marys Food Bank this year. Dont unknowingly forfeit your opportunity to support our mission for FREE.

Donations for tax year 2021 may be made through april 15 2022. Your donation to the QCO tax credit will support organizations assisting low-income children individuals and families. One Arizona Form 321 and Arizona Form 352 the two forms used for the Arizona Charitable Donation Tax Credit two numbers are included for contact with questions about the credits.

Arizonas Children Association Qualifies for the Arizona Charitable Tax Credit. The Arizona Military Family Relief Fund Credit. For the Arizona Foster Care Tax Credit that amount is 1000 for married couples filing jointly and 500 for individual taxpayers and married couples filing separately.

With the Arizona Charitable Tax Credit you can donate up to 800 to St. Help us feed the hungry in Arizona donate the maximum amount to St. For joint taxpayers the maximum credit is 800.

You cant claim. This tax credit is available for cash contributions and is claimed on Arizona Form 322. The tax credit is is available to individual taxpayers who donate the maximum amount allowed under the Credit for Contributions to Private School Tuition Organizations and make an additional donation to a Certified School Tuition Organization.

Arizona Department of Revenue. What You Need to Know About Arizona 2021 Tax Credits 1. Qualifying Charitable Organization QCO Form 321 A credit of up to 800 for those filing as married filing joint and up to 400 for all other filers is available for cash contributions to a qualifying charitable organization QCO.

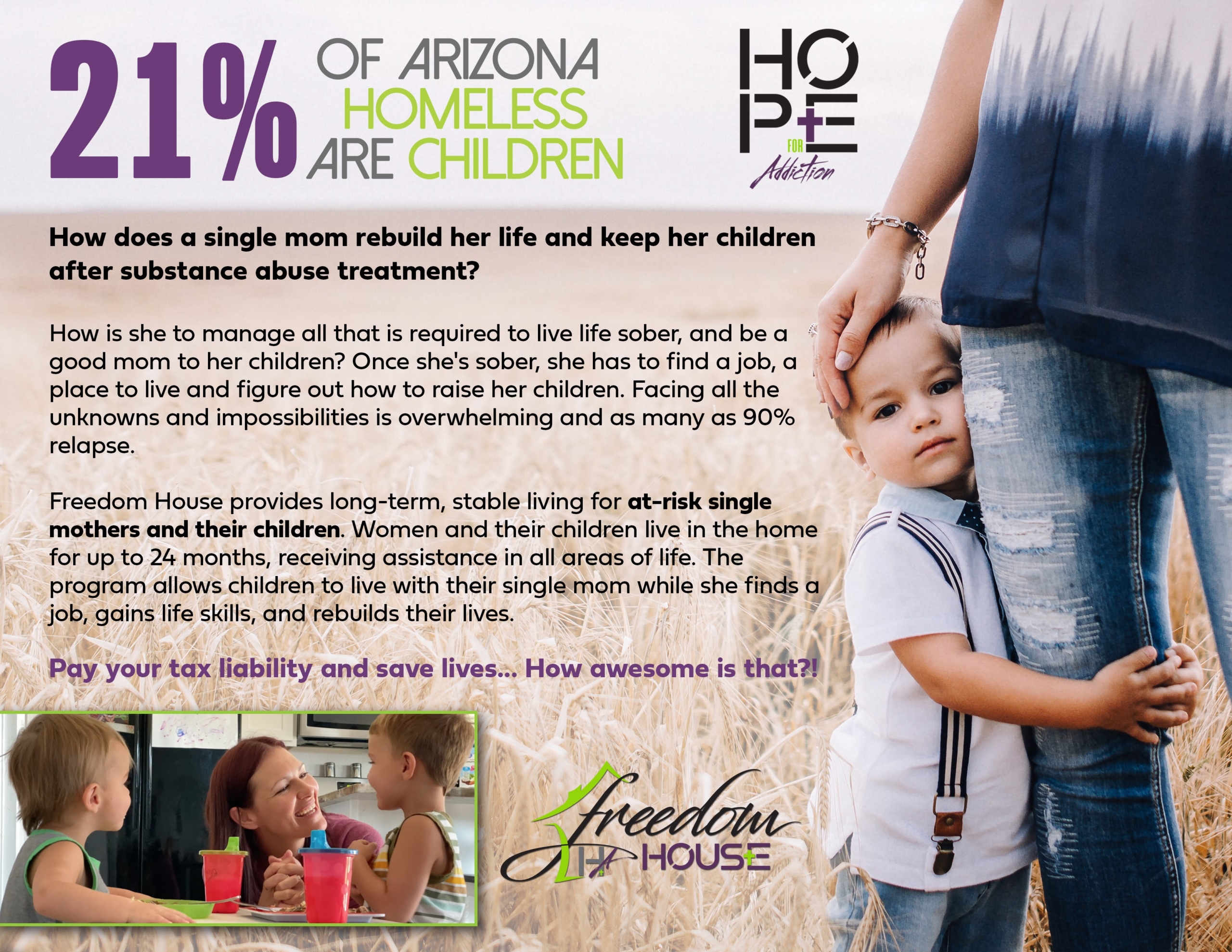

Arizona residents can claim up to 500 filing as an singleindividual or up to 1000 for married couples filing jointly for donations to a QFCO. There are two tax credits available to individual income taxpayers for charitable donations. Donate to these charities for a dollar-for-dollar tax CREDIT Southern Arizona organizations that qualify for 2021 charitable giving tax credit Dec 20 2021.

The only change for the 2021 tax credit was a small increase to the private school donation limits. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. Donate up to 400 single filer and up to 800 married filing jointly and Arizona will deduct 1 for 1 what you owe.

Make a Donation up to 800 with the Arizona Charitable Tax Credit. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Take a credit on your Arizona State tax return Up to 400 for individuals and 800 for couples.

The 2022 list should be used for donations made during 2022. The credit for fees or donations to public schools made between January 1 2022 and April 15 2022 can be claimed either on your 2021 or 2022 Arizona tax return. For Phoenix and all 602 area codes call 602-255-3381.

Chapter 2 Limits to the Tax Credit The maximum credit allowed for contributions to QCOs for single taxpayers married filing separately or head of household is 400. Taxpayers should use the appropriate forms for QCOs claimed on Form 321 and QFCOs claimed on Form 352 as well as the Form 301 the Nonrefundable Individual Tax Credits and. The Working Poor Tax Credit is part of the Arizona Charitable Tax Credit which is the term used to describe the tax credits for donations to QCOs.

Contributions for the 2021 tax year can be made through april. The Arizona Military Family Relief Fund provides financial assistance. These tax credits allow taxpayers to make charitable contributions and receive dollar-for-dollar reductions in their Arizona state.

If you have any questions about this program feel free to reach out to Megan Word Chief of Community Engagement at 602-285-0505 ext. For Tucson and all 520 and 928 area codes call 800-352-4090. St Marys Food Bank Qualifying.

Donations made to these charities between January 2022 and April 15 2022 can be claimed on either your 2021 Arizona tax return or your 2022 Arizona tax return but not both. Donations to QFCOs made up to 1200 AM midnight April 15 2021 may still be claimed on your 2020 tax return.

Qualified Charitable Organizations Az Tax Credit Funds

Watches For Men Women Watches Smartwatch Fashion Video In 2021 Watches For Men Smart Watch Smart Watch Android

List Of 6 Arizona Tax Credits Christian Family Care

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

What You Need To Know About Arizona 2021 Tax Credits

Qualified Charitable Organizations Az Tax Credit Funds

Arizona S Tax Credit For Qualifying Charitable Organizations Qco A Stepping Stone Foundation

Know Each Tax Credit S Limit 2021 Fsl Org

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Tax Credits Charitable Giving Tucson Phoenix Az